Examine This Report about Lamina Loans

Table of ContentsLamina Loans Things To Know Before You Get ThisExcitement About Lamina LoansThe Greatest Guide To Lamina LoansThe smart Trick of Lamina Loans That Nobody is Talking AboutAn Unbiased View of Lamina LoansSome Known Questions About Lamina Loans.The Facts About Lamina Loans Uncovered

- This is an individual lending with an established settlement but an ever-changing rate of interest price for the entire term of the lending. If you want to profit from those times when interest prices are reduced, think about a loan with a variable passion price choice. >> Apply online for an Individual Financing.Sure, you may be able to pay for a made use of car with cash but you will not be able to buy anything else for fairly some time and your financial resources will certainly experience. That's where credit report and also lendings come into the photo.

Get This Report about Lamina Loans

Plus, there are lendings around for nearly anything you might ever before wish to get in Canada. From car financings to home loans and also personal finances to credit cards, Canadians have the ability to use the power of credit report to spend for several kinds of purchases gradually. Let's take a glimpse at some of the primary sorts of fundings in Canada as well as several of the finance products that are best avoided.

A debt record is a document of all the ventures you've had with lending institutions and finances for many years. It helps companies figure out whether they'll prolong you credit scores as well as, if they do, what your rate of interest will certainly be. Passion prices are merely a calculation of riskthe worse your credit history, the higher your danger as well as the greater your passion rate will likely be.

Lamina Loans for Beginners

In brief, there are lots of various kinds of finances in Canada. There are financings for virtually every conceivable kind of purchase from vehicles to products and services.

Safe finances are backed by a details thing, called security. Your auto loan, as an example, is safeguarded due to the fact that if you stop working to pay, your loan provider will certainly retrieve the automobile. Your bank card, however, is unsecured since there is no thing backing your credit report. The credit rating needs for closed and also open or secured as well as unsecured fundings will certainly depend a fair bit on the lender, the loan product concerned, and also your credit history.

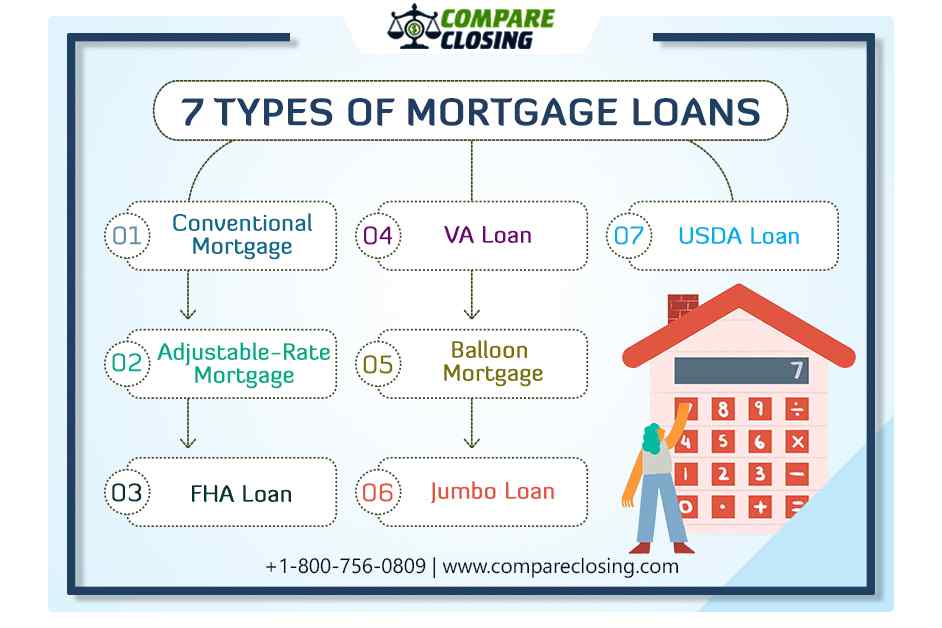

Home loan are a few of one of the most common borrowing products available in Canada. The size of the ordinary home loan has actually ballooned even more than 50% over the course of the last couple of years as homeownership has actually come to be a goal for numerous Canadians. When you're residence shopping, it's essential that you browse for different home loan rates to make sure that you're obtaining the finest feasible bargain.

The Ultimate Guide To Lamina Loans

A residence equity finance servicer might offer you with a line of credit rating based upon a portion of your present equity. Many lending institutions won't give you more than 85% of the equity my response you have in your house as part of one of these financings, but the amount you can obtain will vary from financial institution to bank.

Car car loans are protected, closed-end financings that aid you fund the expense of a new or used automobile. Rates of interest on these financings can vary widely based upon the value of the automobile, the size of the financing, as well as your creditworthiness. New cars and trucks often tend to have lower rates than older cars and trucks due to the fact that they are more valuable.

Either method, be sure to shop about for the ideal price and borrowing terms prior to you authorize up for an automobile lending in Canada. Credit cards are a kind of open-ended line of credit history, as well as they can be either protected or unprotected.

Things about Lamina Loans

Not excellent. Personal car loans are closed-end, unsecured credit lines that are utilized for a range of different objectives. Whether it's building and construction on your home or moneying a holiday, individual lendings can usually be made use of to finance your acquisitions (but confirm any kind of spending limitations from your lending institution before you apply).

Rate of interest can likewise be really high up on individual fundings, particularly if you don't have great debt. For that reason, if you're taking into consideration a personal loan, you ought to always strongly think about whether you really need to borrow money for your purchase. If these details you need the money for something important, such as residence repair services, and you can pay for to pay back the financing, it might be a beneficial choice.

After that, you'll be accountable for repaying your purchase over time (generally in 4 to 5 installments). The majority of these lendings have no rate of interest if you pay them back promptly but they might charge late settlement as well as other similar costs. While there isn't typically an interest rate connected with this kind of financing product, you will likely still have your credit history inspected when you enroll in this kind of service.

Indicators on Lamina Loans You Should Know

There are as various kinds of financing tools in Canada as there are products to finance with them, for instance, Loans Canada is comparison system that will certainly help you locate the finest rate. If you decide to secure a financing, make sure to do your homework to ensure that you recognize what you're signing up for.

As the name suggests, government student loans are released by the federal government. They belong to the Division of Education's William D. Ford Federal Direct Loan Program. Federal trainee car loans are damaged down into 4 categories: Straight Subsidized Lendings, Straight Unsubsidized Loans, Direct PLUS Loans as well as Direct Debt Consolidation Loans. Within those categories, there are loan choices for undergraduate students, graduate pupils, professional trainees and also even over at this website moms and dads.

Rates of interest on government pupil fundings are established each spring by the federal government as well as are all dealt with. Federal student finance rates of interest aren't based on the credit report of specific customers, as well as they remain the same throughout the loan. Here's exactly how each sort of federal funding jobs: Direct subsidized fundings are readily available to undergraduate students of a college or occupation college who demonstrate monetary demand.

How Lamina Loans can Save You Time, Stress, and Money.

Due to the fact that subsidized pupil fundings are based on demand, they usually have much better terms than other sorts of fundings. Lamina Loans. As an example, the federal government will certainly pay for the passion on subsidized fundings as long as the customer is enrolled in institution at least half the moment. It will certainly likewise cover rate of interest payments for six months after graduationknown as a moratorium.

Customers, not the federal government, are generally in charge of paying interest that builds up during institution, poise periods as well as deferments. This remains in part as a result of a process called capitalization. Borrowers are accountable for paying passion, the price undergraduates pay for unsubsidized financings is the same as the rate for subsidized lendings.