Lamina Loans Things To Know Before You Get This

Table of ContentsAbout Lamina LoansGetting The Lamina Loans To WorkLamina Loans Can Be Fun For EveryoneLamina Loans for DummiesHow Lamina Loans can Save You Time, Stress, and Money.The Facts About Lamina Loans RevealedSome Known Details About Lamina Loans

True, also if your credit rating health is reduced, there are subprime lending institutions out there who can give you the individual funding you need. As we stated, your interest price can end up being extremely high, costing you hundreds, also thousands of dollars additional.

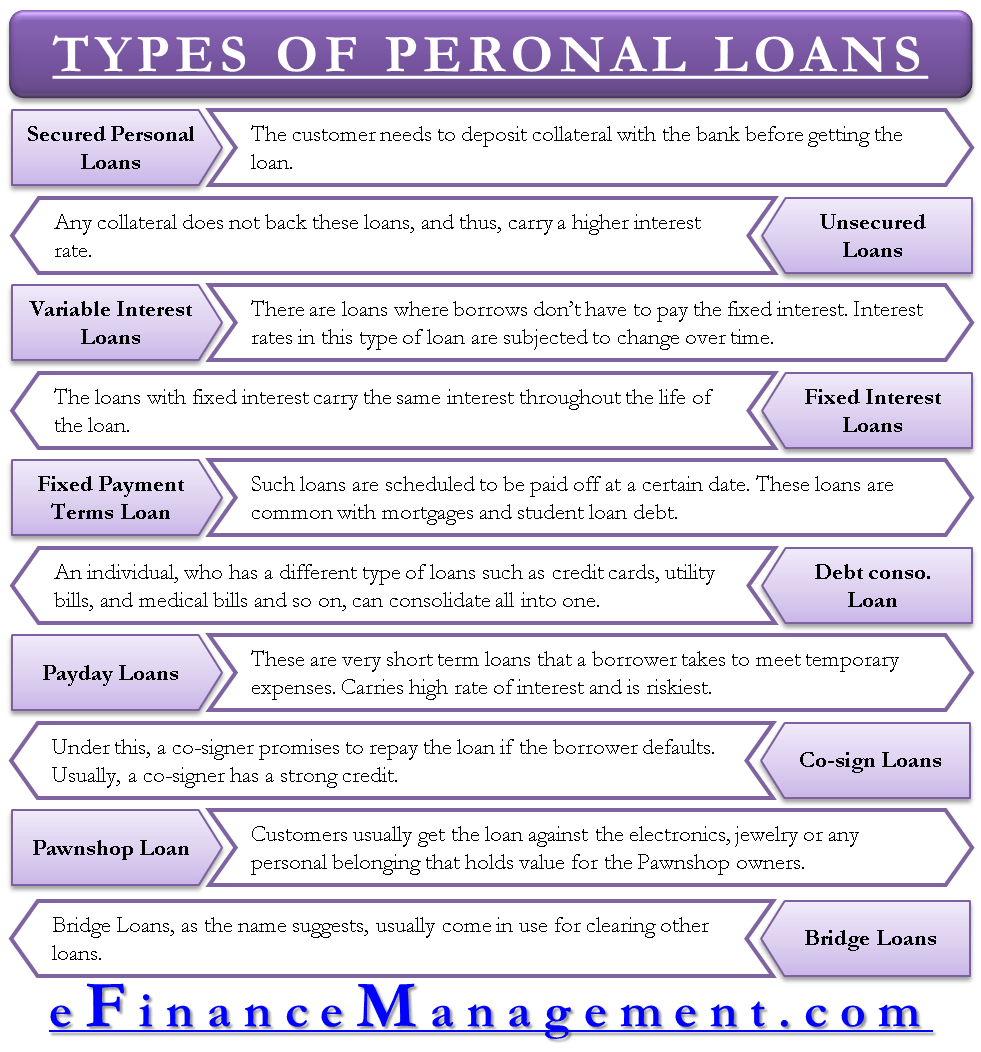

If you're seeking a low-interest individual lending in Canada, there are a few points you can do to obtain one. Funding rate of interest fundings can be obtained by doing several of the following: As previously stated, collateral lowers the lending institutions' borrowing risk. They are extra prepared to give a low-interest finance when you offer an asset as security.

The Facts About Lamina Loans Revealed

Like collateral, this offers your lending institution with additional security. You can get a low-interest car loan in Canada, if you obtain a cosigner for your financing. Your credit score can significantly impact the rate of interest rate you hop on your loan. The higher your credit history, the extra most likely you'll qualify for a low-interest car loan in Canada.

Your own negative debt will certainly no longer be a concern during the application process. Preferably, your cosigner would certainly need to have excellent credit score and also a respectable income.

Yes, there are several alternate lenders in Canada that supply personal fundings with no credit score checks. Instead of your credit report score, they will evaluate your earnings degree, employment security, debt-to-income ratio as well as other economic elements that will certainly determine your credit reliability. When making an application for a personal lending you'll need to supply certain documents for verification and also identification functions.

Lamina Loans Fundamentals Explained

The rate you're charged depends on your lending institution, your credit history rating, your debt-to-income ratio, and also your lending terms. On standard, rate of interest prices vary anywhere between 15% and also 45% for a personal loan.

Click the switch below to fill up out an application to see what your alternatives are.

Unsafe methods that you're obtaining cash without putting anything up as collateral to "secure" the funding. These loans typically need a higher credit scores score to confirm your creditworthiness.

Some Known Details About Lamina Loans

Some lenders could also allow you to set an affordable payment quantity based upon your income and rate of interest. Compare individual financing lending institutions before you make a choice, so you can locate the appropriate terms for your scenario. You can normally obtain a personal lending for whatever you need it for like house enhancement or financial debt loan consolidation.

:max_bytes(150000):strip_icc()/Term-Definitions_loan.asp-b51fa1e26728403dbe6bddb3ff14ea71.jpg)

The lower your score, the less likely you are to qualify and if you do, the greater your rates of interest will certainly be. You'll require to prove you can pay for to pay check the financing back. If you do not have a constant job with a trustworthy income, you may not obtain approved for a lending.

Not known Details About Lamina Loans

If you default on your financing, the loan provider can confiscate the property you placed up as collateral.

Due to the fact that you're utilizing something as security, protected loans are much easier to obtain for people with lower credit history ratings. Because there's collateral, the lending institution views you as a much less dangerous consumer, so interest rates tend to be reduced on guaranteed financings If you don't make on-time payments, your security can get removed.

A safe lending is excellent for someone that does not have a suitable credit history for a loan however requires one anyway. If you do not have a high credit report, think about a protected finance to show you can make repayments on schedule monthly. A revolving credit line offers you accessibility to cash that you can borrow as much as your credit line.

8 Simple Techniques For Lamina Loans

If you bring a balance, you more than likely will have to pay passion on top of that quantity - Lamina Loans. Revolving credit score is available in the form of credit report cards, a credit line, or a house equity credit line (HELOC). If you have actually got costs that are due, however don't earn money for a few weeks, revolving credit score can aid you pay those expenses.

Numerous credit history cards supply rewards for usage, like cash money back, factors, or other incentives. why not find out more This amount can vary based on exactly how you utilize your revolving debt.

This is the reverse of rotating debt, where you can take money out and also pay it back over the program of a few months or years, depending on your contract.

The Greatest Guide To Lamina Loans

If your installation loan has a fixed rate of interest, your finance settlement will certainly coincide on click a monthly basis. Your budget will not rise and drop based on your repayments, which is helpful if you do not have a great deal of wiggle area for change. Installment car loans don't permit you to return and also take out more in instance you need it.

Or else, you might require to secure one more car loan. Having a set quantity you need to obtain and also pay back makes installment financings ideal for somebody that understands exactly just how much they need as well as just how much they can pay for. A set rate of interest is a rate that does not transform over the life of the financing.